How interest rate jumps affect purchase decisions and affordability in CA

Mortgage rates have shot up in the two weeks following the election,  moving to highest levels in two

moving to highest levels in two

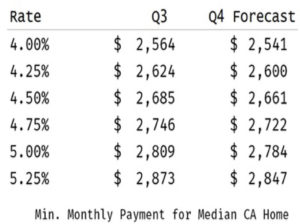

years, with the 30-year fixed rate loan at 4.25 percent. This has instantly pushed up the cost of borrowing and home purchasing for many people in California, caused many to try to lock in current rates and has caused an immediate drop in mortgage refinancing. Homebuyers on the market are pushing to lock in rates and to speed through closings: the median monthly payment for a California single family home instantly jumped up $110 from the pre-election median price of $2510. Each .25% increase in rates translates into roughly a $60 increase in payments.

The rapid jump was driven by a mix of expectations of inflation, Fed rate hikes, and anticipation of the new administration’s fiscal and tax policies. For many people looking to buy this means pushing forward to lock in rates that are still at historically low levels, with an eye for further upward movement over the coming months and years.

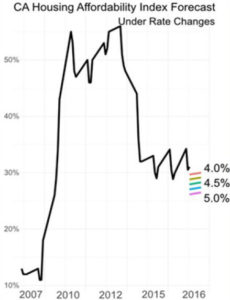

Near-peak prices, low levels of affordable homes on the market and the non-existence of new building, particularly – for entry-level homes, have combined to drive affordability in California to lows. Rate jumps will further suppress the number of people who can afford to buy, and while price increases in the future will moderate, affordability will not improve if current market conditions persist . As such, sales activity in the California housing market may stall or even slowdown in the coming years. Both buyers and sellers will need to acclimate to the reality in the future that supply may increase, but only due to fewer buyers at middle and lower housing price segments.

Near-peak prices, low levels of affordable homes on the market and the non-existence of new building, particularly – for entry-level homes, have combined to drive affordability in California to lows. Rate jumps will further suppress the number of people who can afford to buy, and while price increases in the future will moderate, affordability will not improve if current market conditions persist . As such, sales activity in the California housing market may stall or even slowdown in the coming years. Both buyers and sellers will need to acclimate to the reality in the future that supply may increase, but only due to fewer buyers at middle and lower housing price segments.